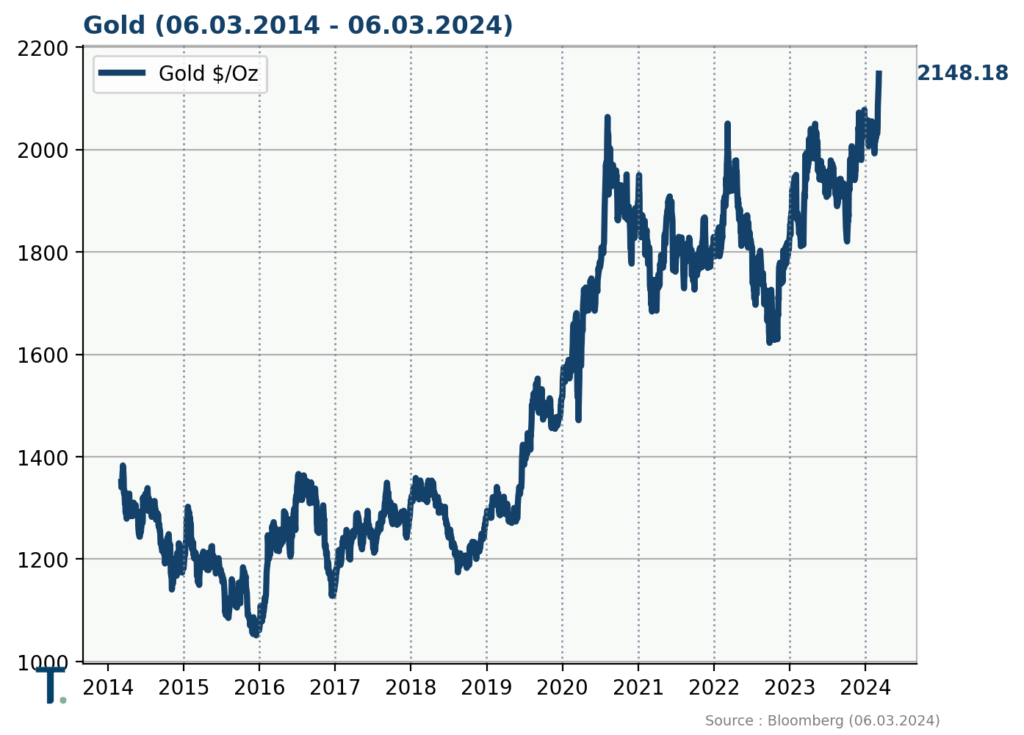

Fitting together the pieces of today’s economic and financial puzzle is no easy task. What is the true state of the Chinese economy? How will the geopolitical situation evolve in the Middle East and Ukraine? What will the US presidential election bring? Why have bond and equity markets disconnected so markedly since mid-January? And with risk appetite seemingly strong again (witness the AI and bitcoin “bubbles”), how can it be that gold – the ultimate safe haven – is also trading at historical highs?

Our take on China is somewhat rosier that the broad consensus. There is no question that the news flow coming out of the country has been negative for many quarters, particularly with regards to the real estate sector. That said, we find last month’s very sharp increase in Chinese iron ore and coal imports (from Brazil and Australia respectively) intriguing. Given that imports of basic resources are always the starting point for faster economic expansion, we consider the 5% GDP growth target for 2024 recently put forward by the Chinese authorities to be definitely achievable. We would also stress that, although “low” from a historical perspective, such a rate of expansion remains impressive when considering the current size of the Chinese economy.

How much of a tailwind will a stronger China provide to Western economies? This will of course depend on what Chinese factories do with the additional steel made available by higher iron ore imports. And also on how US and European authorities react to the ongoing Chinese push into the electrical vehicle and wind turbines markets, amongst others. We would, however, be surprised to see a repeat of the solar panel scenario, where Europe effectively lost the market to China – with the wind turbine industry currently under similar threat. Car manufacturers are very important to Germany, France and Italy, the EU’s three largest economies. It is thus likely that a subsidy programme be implemented by EU authorities, following in the US’ footsteps, to sustain the European automotive sector against Chinese competition, possibly combined with (higher) import taxes. Which in turn means that the uptick in Chinese growth might prove less export-driven than in the past, except within the Far East itself. Investments in – currently very cheap – Chinese equities should thus rather be focused on opportunities in the domestic economy.

In the US, the primaries are now in full swing and clearly resulting in a “remake” of the 2020 Biden vs. Trump duel – even though much of the population would arguably prefer to have to choose between different (younger) protagonists. Unless the Supreme Court were to declare him ineligible, which is highly unlikely given the preponderance of Republican-appointed justices, there is a real chance that Donald Trump will move back into the White House at the end of this year. Which in turn could have major implications for both the Israel/Hamas and Russia/Ukraine conflicts. Up until now, financial markets have expressed very little concern, but that could suddenly change.

In the EU too, 2024 is an election year, with a shift to the right a distinct possibility. Judging by the recent Antwerp declaration for a European Industrial Deal, signed by more than 600 companies and organisations, representing 20 sectors of activity and employing 7.8 million workers, such an electoral outcome could pave the way for greater subsidies of EU industry and restrictions on extra-European imports. The text of the Antwerp declaration is clear: faced with “a US economy that benefits from the financial support from the Inflation Reduction Act (IRA) and its ease of accessibility, a Chinese overcapacity (…) Europe needs a business case, urgently”.

Also possibly looming is a change in EU voting rules, such that unanimity be required only for the limited number of matters that interfere with national constitutions. This stems from the recognition that the need for unanimous decisions to date has mostly served as a hindrance to effective EU decision-making.

As for financial markets, the equity/bond decoupling that has occurred since mid-January is certainly striking. It results either from differing perceptions in each market regarding when – and by how much – central banks will cut interest rates or, more likely, it reflects equity investor hopes that better corporate earnings will more than offset the impact of “higher for longer” rates. In fact, the equity rally has narrowed even further in 2024, with the number of “magnificent” AI-related stocks shrinking from seven to four. More than risk appetite, what seems to be ruling financial markets these days is momentum. Said differently, investors only want to buy what has already been moving up. The ongoing trend of investing through index ETFs only reinforces this phenomenon.

Even more puzzling in our view is the recent decision by the US Securities and Exchanges Commission (SEC) to allow the launch of bitcoin ETFs, even as central banks warn investors about their fictitious value. “Encouraging” money to flow into an asset whose supply is, by definition, limited, and even finite, can only result in a form of “self-fulfilling prophecy”. Or, more cynically, a repeat of the 17th century Dutch tulip mania. We are happy to reiterate our position here: bitcoin has no intrinsic value so long as it is not considered legal tender. That is, so long as it cannot be used to pay taxes, amongst other things. Investing in bitcoin thus amounts to playing the game of the “greater fool”, counting on the fact that someone will show up later who is willing to pay more for something that is actually worth nothing intrinsically. Once again, if need be, our readers are warned.

Gold, which usually shines during times when investors are worried and seeking somewhere to hide, also just posted all-time highs. Its rally is being fuelled by purchases by some central banks that are systematically adding to their gold reserves – to the detriment, notably, of dollar holdings. The rise in the price of gold is thus of a different nature to that of bitcoin. It is not caused by speculators, hence firmer. Investors, meanwhile, have not yet boarded the train, judging by the outflows currently experienced by gold ETFs. This could reverse though, if momentum investors were to suddenly enter this market also and direct money back into gold trackers.